HOPKINSVILLE, KY (CHRISTIAN COUNTY NOW) – Hopkinsville may soon have the lowest net profit tax rate in the state as officials make the first move toward accepting a 1.3% rate. The Hopkinsville Committee of the Whole voted to move forward with this slightly lower rate after receiving pushback for initially denying the recommendation.

Discussion about changes to the net profit tax were initiated in fall of 2024, when local businesses were vocal about extreme influxes in their rates. This resulted in the creation of committee to further evaluate, with the decision now in the hands of the city council.

History of tax fluctuation in Hopkinsville

In January 2023, the City of Hopkinsville eliminated their $10,000 limit on net profit taxes for businesses. Previously, businesses paid 1.5% of their net profits, but their contribution would not exceed $10,000, regardless of how much they earned. With the removal of this limit, all businesses pay a flat 1.5% of their net profits.

Currently any incoming net profit tax revenue over $10,000 is being split between the city’s Economic Development Fund and Future Fire Station Reserve Fund. While the removal of the cap resulted in increased contributions from higher-earning industries, some businesses have expressed concerns and called for the tax limit to be reinstated, which would reduce revenue for the city.

In November 2024, several representatives from agriculture businesses in the city voiced their concerns, with H&R Agri-Power sharing that they experienced a sudden 700% increase in net profit tax, and Krusteaz noting a 1,400% increase. Siemer Milling, and the Kentucky Commissioner of Agriculture also shared similar objections at the time. In response, the council created a committee to best evaluate their options moving forward.

COTW initially denies lower rate, Judge Executive gets involved

At the Sept. 18 Hopkinsville Committee of the Whole meeting, councilmembers discussed the recommendation presented by the Maximum Tax Liability Committee, which concluded that the city should lower the Net Profit Tax Rate to 1.1% from the current rate of 1.5%.

After City CFO Melissa Clayton presented the information, she followed up by saying that despite the recommendation, accepting a lower rate would affect the city’s bond rating and negatively impact revenue. Councilmember Clayton Sumner addressed Mayor J.R. Knight during the meeting requesting that he “picks a side” on the matter.

“As a business owner, I’d say yes. But as a man looking at the books, I have to say no,” said Mayor Knight. The COTW did not accept the recommendation and did not forward the lower tax rate to council for a vote.

Fast forward to the Oct. 22 Hopkinsville City Council meeting, where Brandon Garnett justified the lower rate that the committee recommended. Garnett is the Regional Vice President of Agricultural Lending at Farm Credit Mid-America, who was part of the group of businesses owners that spoke against the tax in 2024. Christian County Judge Executive Jerry Gilliam also addressed the council, yielding his time back to Garnett to ensure councilmembers understood the implications.

“You see these tariffs that President Trump has put on these other countries, and what’s happened is a lot of these companies are now moving their businesses back to the U.S. to avoid that tariff,” said Gilliam to the council. “What’s going to be created here is the opposite effect. You’re going to see businesses locate elsewhere to avoid this type of tax.”

COTW discusses lower rate again, State Representative steps in

The rate was added back to the agenda for the COTW, with District 9 State Representative Myron Dossett present during the Oct. 23 meeting. He shared that business owners from the city have reached out to him with concerns.

“It’s very important to look at these businesses here locally and remember the impact they have on Christian County,” said Dossett, emphasizing the revenue that impacted businesses bring in, and the good they do to support the community. He urged the councilmembers to look at the net profit tax to ensure these businesses stay. Mark Bowling, Chief of Staff for the Kentucky Department of Agriculture, also spoke in favor of re-evaluation at the meeting.

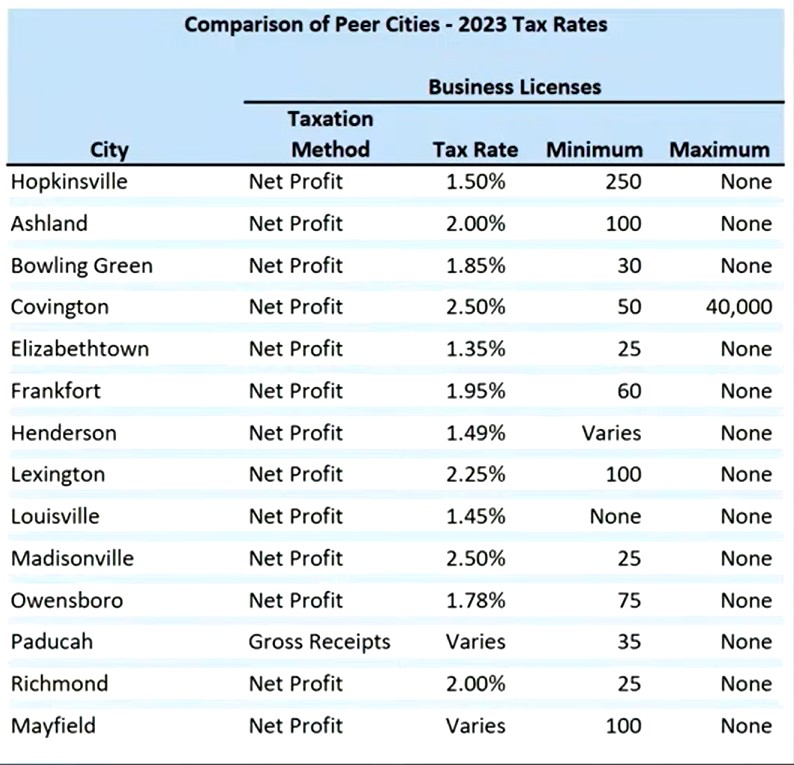

City CFO Melissa Clayton said the 1.1% rate would cause the city to lose $400,000 in revenue. Even lowering it to 1.3% would result in a $200,000 loss. She pointed out that both of the recommended rate options would make them the lowest in the state with the current 1.5% rate, which is already the fourth lowest in the state.

“We owe it to the taxpayers of the city, and to the business owners large and small to do the best for all of them that we can,” said Councilmember Donald Mash. After lengthy discussion, a motion was made to approve a 1.3% net profit tax rate that would take effect in the 2026-27 fiscal year.

The motion passed 7-5 with councilmembers’ Jason Bell, Elizabeth Draude, Vance Smith, Chuck Crabtree, and Amy Craig all voting against. Voting in favor were councilmembers’ Michael Valez, Brandi Stallons, Donald Marsh, Travis Martin, Clayton Sumner, Brittanie Bogard, and Seth Meek.

The vote passed and will now be moved to city council for a first and second reading.

| STAY UPDATED ON LOCAL NEWS: Sign up for the midday Christian County Now newsletter.